Delivery Performance Commitment for OEM/ODM Water Purification Equipment Manufacturers - How to Avoid Factory Closure Issues

In a fiercely competitive and ever-changing market, some OEM/ODM contract manufacturers may face financial instability in the early stages, leading to operational difficulties when economic conditions are challenging or due to the impact of COVID-19. In this article, we will specifically explore how such challenges in water purification equipment contract manufacturing can pose significant risks to both upstream and downstream stakeholders and why they can trigger financial crises in contract manufacturing factories. We will also discuss how careful partner selection can help mitigate the risk of OEM/ODM contract manufacturers closing down, ensuring the timely completion of your delivery plans.

Introduction to the Contents:

1) Case Study: Closure of a Water Purification Equipment OEM/ODM Contract Manufacturing Factory in Taichung.

2) Why Do OEM/ODM Contract Manufacturing Factories Experience Financial Crises Leading to Closure?

3) The Significance of Financial Management for OEM/ODM Contract Manufacturing Factories.

6) Practical Financial Management Practices at Yirui Water Purification Company.

1)Closure of a Water Purification Equipment OEM/ODM Contract Manufacturing

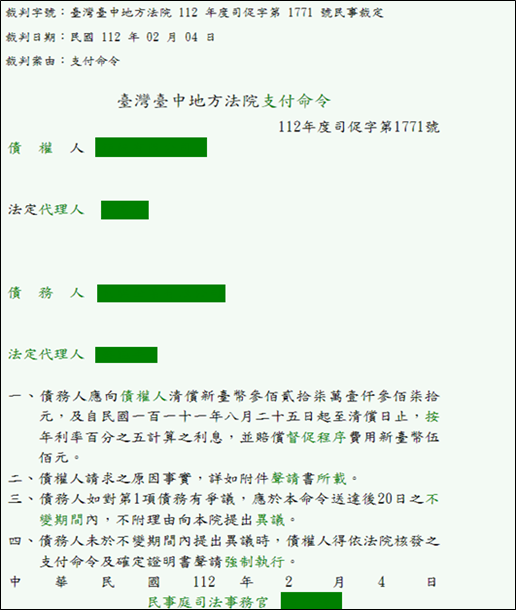

Factory in Taichung On September 26th, 111th year of the Republic of China (2022), Yahoo's stock market app (https://reurl.cc/GAWXxG) reported a case involving a Taiwanese publicly-listed water purification equipment company facing a significant financial setback due to the closure of a water purification equipment factory in Taichung. The factory abruptly ceased its operations, leaving behind a staggering outstanding debt of NTD 536,000,000 (New Taiwan Dollars). This unexpected closure has raised various legal and financial concerns, as illustrated in "Figure One," where multiple suppliers are pursuing payment orders through the Taichung Court.

Figure One: Payment Orders Issued by the Taichung District Court, Taiwan

Reference Source: Judicial Yuan Judgment System

2)Why OEM/ODM Contract Manufacturing Factories Face Financial Crises and Closure

There are several common factors that can lead to financial crises and, ultimately, the closure of OEM/ODM contract manufacturing factories. Here are seven key reasons:

- Market Demand Fluctuations: Intense competition in the contract manufacturing industry can result in unstable market demand, posing a significant challenge to these factories. For instance, the COVID-19 pandemic led to the closure of numerous small businesses, affecting market demand negatively (source: ETtoday News).

- Insufficient Capital: Operating an OEM/ODM factory requires substantial capital investment, including purchasing raw materials, updating equipment, and covering employee salaries. If a company expands too rapidly without having adequate funds to manage these expenses, it can face financial difficulties.

- Production Efficiency Issues: Low production efficiency can lead to increased production costs, delayed product deliveries, and decreased customer satisfaction. Poor product quality and numerous customer complaints can also result in financial crises, especially if there are returns and compensation demands.

- Poor Management Performance: Inadequate decision-making and management errors by the leadership can contribute to a factory's financial crisis. Factors such as a lack of commitment, excessive socializing, or the absence of sound systems can lead to ineffective business strategies and risk management, putting the factory at a competitive disadvantage.

- Inappropriate Investments: Inadequate investments can lead to financial crises during business operations. For example, excessive investments in new technologies, products, equipment, or markets without conducting thorough risk assessments can result in high costs and insufficient returns. This can lead to cash flow problems, an inability to cover daily operating costs, and eventual closure.

- Rapid Expansion: Rapid expansion to capitalize on market growth can also lead to financial instability. Expanding production capacity, increasing human resources, and purchasing new equipment all require substantial financial resources. Poor resource management can lead to issues like uneven resource allocation, overcapacity, and high costs, ultimately causing financial difficulties.

- Inadequate Diversification: Over-reliance on a single customer or product can make a contract manufacturing factory vulnerable to market fluctuations and changing demands. If the demand from a major customer decreases or a product becomes obsolete, the factory may struggle to adapt or find new sources of income. This situation can lead to financial distress and closure.

To avoid these issues, contract manufacturing factories should closely monitor market trends, develop effective business strategies, manage finances prudently, enhance production efficiency, and strengthen management capabilities. These measures can improve competitiveness, promote stability, reduce financial risks, and ensure the long-term sustainability of the factory.

3) The Importance of Financial Management for OEM/ODM Contract Manufacturing Factories

The emphasis on financial conditions by contract manufacturing factories is crucial for maintaining stable operations and avoiding financial crises. In highly competitive market environments, these factories must exercise prudent financial management to ensure long-term development.

- Establishing a Comprehensive Financial Management System: Contract manufacturing factories need to establish a comprehensive financial management system, including effective financial monitoring and reporting mechanisms. This allows them to stay informed about the company's financial health and operational performance in a timely manner. For instance, through the analysis of financial statements, potential risks can be identified, and appropriate measures can be taken promptly to prevent the escalation of financial issues. Additionally, careful management of funds is pivotal to maintaining smooth operations. Proper allocation of funds based on market demand and production progress helps prevent disruptions caused by insufficient capital.

- Increasing Revenue and Reducing Costs: Contract manufacturing factories should actively seek ways to increase revenue and reduce costs. Expanding into new markets and attracting new customers can boost income streams. Simultaneously, optimizing production processes, enhancing production efficiency, and lowering production costs can enhance competitiveness.

- Maintaining a Prudent Debt Level: Furthermore, contract manufacturing factories should maintain a prudent debt level. Excessive borrowing can increase financial risks and lead to overwhelming debt burdens. Therefore, these factories should carefully assess the risks associated with borrowing and exercise control over debt levels. This ensures financial stability, enhances resilience to risks, and guarantees the long-term stability of operations.

4) How Downstream Buyers Can Evaluate the Financial Condition of OEM/ODM Contract Manufacturing Factories:

- Bank Enquiries: Downstream buyers can inquire with banks regarding the financial transactions and history of the contract manufacturing factory. This may involve contacting the bank by phone to gather information such as whether there have been instances of bounced checks, how long the factory has held its bank account, and the creditworthiness of the factory's accounts. This process helps assess the creditworthiness of the procurement partner and whether they have sufficient financial capability to fulfill the terms of the transaction. It also aids in identifying any potential financial risks associated with the factory.

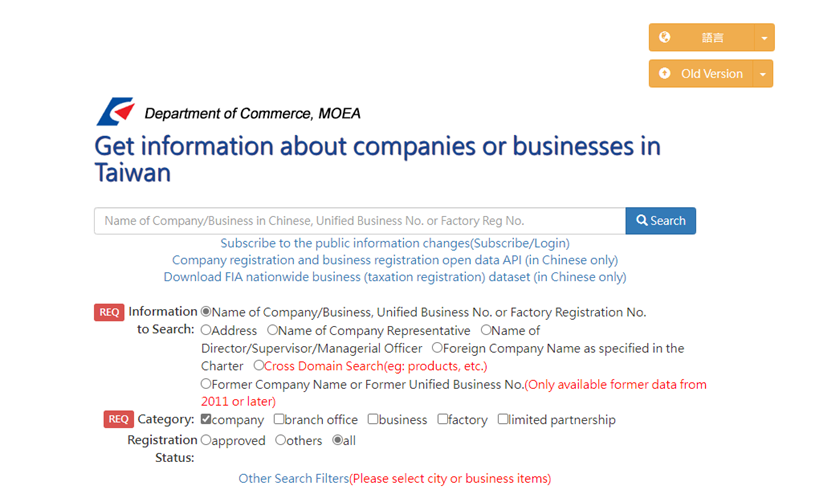

National Business Registration Portal: Utilizing the National Business Registration Portal provided by the Ministry of Economic Affairs, buyers can access publicly available information about the procurement partner's company, including its registered data and capitalization. This information serves as a valuable reference for evaluating the financial standing and stability of the contract manufacturing factory.

Figure Two: Business Registration Public Information Inquiry Service

Reference Source: National Business Registration Portal

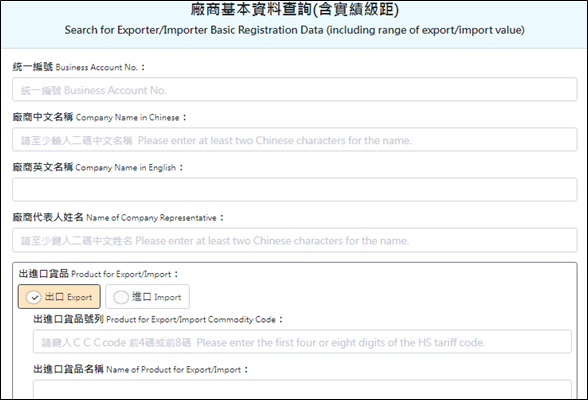

3. Company Information Inquiry: The publicly available website provided by the Bureau of Foreign Trade, Ministry of Economic Affairs, allows buyers to access information about the procurement partner's company. This includes details such as company data, product imports and exports, and import/export qualifications. This information serves as a valuable reference when evaluating the procurement partner's suitability and reliability.

Figure Three: Company Information Inquiry

Reference Source: Import and Export Firm Registration System

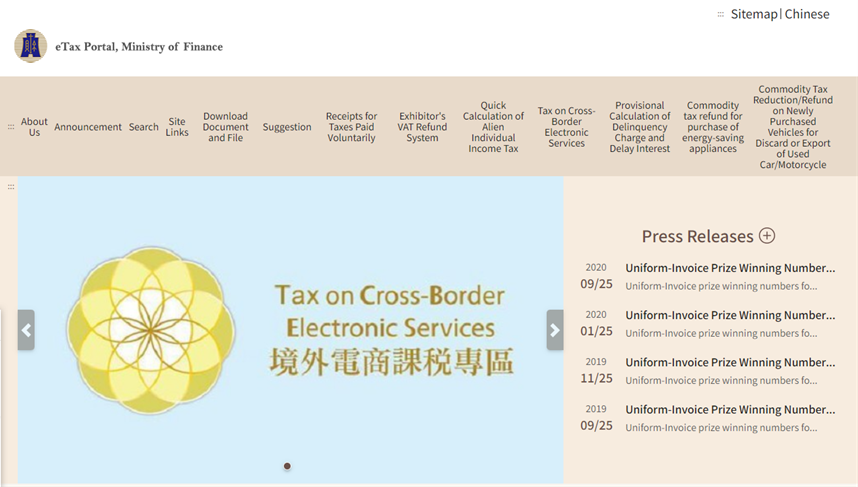

4. Tax Registration Data Public Information Inquiry: The Ministry of Finance's Tax Portal website provides the capability to access information about the procurement partner's company. This includes details such as company data, capitalization, registered business activities, and more. This information serves as a valuable reference for assessing the procurement partner's financial and tax-related information.

Figure Four: Tax Registration Data Public Information Inquiry

Reference Source: Ministry of Finance Tax Portal

5. Court Litigation Records: You can check whether the OEM/ODM contract manufacturing factory you are dealing with has been involved in any debt recovery lawsuits through relevant websites. This can provide insights into the creditworthiness and financial condition of the OEM/ODM factory.

6. Competitor Intelligence: Periodically seeking competitive intelligence from competitors of the contract manufacturing factory you are dealing with can provide you with valuable insider information. This can help in assessing the financial health of the contract manufacturing factory.

7. Offering Promissory Notes: If your contract manufacturing factory requests an equivalent deposit when placing an order, you can request the issuance of a commercial promissory note from the factory. This measure helps secure your interests and ensure payment if needed.

5) How Upstream Suppliers of Raw Materials and Components Can Ensure Timely Receipt of Payments from OEM/ODM Contract Manufacturing Factories:

To ensure accurate receipt of payments from buyers and responsibly deliver payments to upstream suppliers of raw materials and components, we provide the best practices of Yirui Water Purification Company for your reference:

- Regular Supplier Invoice Reconciliation: On the fifth day of each month, we conduct a reconciliation of invoices from upstream suppliers. We carefully verify each transaction to ensure that nothing is omitted or incorrect. This ensures that we can provide accurate payments when due, reducing potential disputes.

- Request Invoices from Raw Material Suppliers and Remind Them to Invoice: Once we confirm the accuracy of invoices from upstream suppliers, we request them to issue correct invoices promptly. We also send reminders to ensure they send the invoices on time and initiate the billing process.

- Wire Transfers for Payments: Upon receiving error-free commercial invoices from raw material suppliers, we internally ensure that all payments are wired to the respective suppliers before the end of the month.

6) Practical Financial Management Practices at Yirui Water Purification Company:

- Advance Payments: Yirui Water Purification Company uses advance payments received from customers exclusively for the procurement of raw materials related to customer orders. This ensures the healthy flow of funds without diverting them for other purposes.

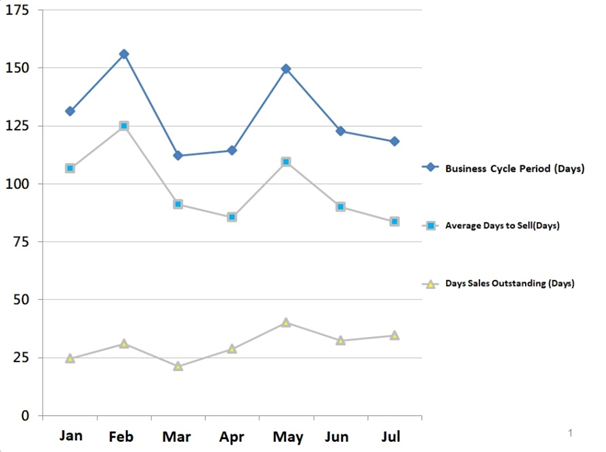

- Accounts Receivable: Yirui Water Purification Company prepares management reports every month for financial capability analysis.

(1)Inventory Turnover Rate (Times): Managing the average speed from inventory to sale, aiming for a high turnover rate.

(2)Days Sales Outstanding (DSO): Managing the time it takes from sales to cash collection, aiming for a shorter DSO.

(3)High inventory turnover (fast sales) and a short DSO naturally result in a robust cash flow, maintaining a healthy financial condition.

Figure Five: Financial Capability Analysis

3. Debt-to-Asset Ratio: YiRui Clean Water maintains a debt-to-asset ratio consistently below 50%. Generally, a debt ratio exceeding 50% is often considered a red flag, and it's advisable to keep it below 60%. A high debt ratio usually means the company is paying a significant amount in interest expenses and is exposed to higher financial risks. (Source: Kangaroo Finance)

- Debt Servicing Capability Analysis: Assuming that a company faces a financial crisis with no value in inventory and prepaid expenses, the company's short-term debt-servicing ability can be assessed using quick assets against short-term liabilities, with an ideal quick ratio of 100%. YiRui Clean Water typically maintains a quick ratio of around 170%. (Quick Ratio: Quick Assets / Current Liabilities)

- Cash Reserves and Banking Support: To ensure timely payments to upstream suppliers, YiRui Clean Water is well-prepared in terms of finances. We own our land and factory, and our bank provides a significant credit line, up to five times our monthly operating capital needs. These measures help us handle unexpected situations and ensure we have enough funds to pay our suppliers. Through these measures, we ensure that our upstream suppliers of raw materials and components receive their payments promptly. YiRui Clean Water is committed to establishing reliable and mutually beneficial partnerships to safeguard the interests of both parties.

- Reducing Credit Risk:

(1) Full Prepayment: Requesting customers to pay the full amount before shipment to reduce the credit risk.

(2) Using China Export & Credit Insurance Corporation: China's export and credit insurance mechanism ensures transaction security. In case of risk, insurance can provide compensation to reduce losses.

(3) Releasing Bills of Lading After Payment Confirmation: Bills of lading are only released after receiving payment, ensuring payment and delivery occur simultaneously.

(4) Releasing Credit After Credit Check: Conducting a credit check and releasing credit only after confirming the creditworthiness to reduce risks.

(5) Using Letters of Credit (L/C): Using letters of credit as a payment method with the bank as an intermediary to ensure payment security.

7) How YiRui Clean Water Company Protects Customer Rights in Case of Financial Crisis

YiRui Clean Water Company has maintained sound financial performance over its 37-year history and has never encountered any financial crises. We have consistently respected the rights of our downstream partners and have always upheld our commitment to not delay payments to upstream suppliers. Through rigorous financial management and reserves, we adhere to the principles of sound finance, ensuring the long-term development of YiRui Clean Water Company. However, to ensure the company's long-term sustainability and considering the rights of customers, shareholders, employees, and suppliers, we have developed emergency crisis management measures. In the event of a genuine financial crisis, YiRui Clean Water Company will take the following steps to safeguard the rights of customers and upstream collaborators:

- Convene a creditors' meeting to reach a consensus with YiRui Clean Water Company's upstream suppliers on how to settle debts or provide an opportunity for the company's revival.

- In the event of immediate company closure, products unique to customers and lacking market liquidation value will be used to offset the prepayments made by the original customers as the most valuable option.

- If customers own molds, YiRui Clean Water Company will contact customers to return them.

- If orders have been accepted but production has not commenced, YiRui Clean Water Company will unconditionally refund the deposits to customers.

- If customers temporarily cannot find alternative suppliers with similar products, YiRui Clean Water Company will assist customers in finding or recommending alternative manufacturers.

8) Conclusion The primary purpose of this blog post is:

- To serve as a constant reminder for YiRui Clean Water Company to engage in financial planning and maintain financial health to avoid falling into a financial crisis in the future.

- To share and encourage fellow water treatment industry businesses to focus on financial soundness to prevent adverse impacts on both upstream and downstream customers and suppliers. YiRui Clean Water Company places a strong emphasis on prepayments, timely payments to upstream raw material and component suppliers, maintaining a healthy debt-to-asset ratio, and protecting customer rights. In the event of a financial crisis, we are committed to safeguarding customer rights, assisting customers in finding alternative suppliers, and handling closures responsibly and with sincerity. Through these efforts, we hope to maintain steady growth in a highly competitive market and provide our customers with lasting and reliable OEM/ODM services.

Reference: [List of references, if applicable]